Традиционные методы обнаружения болезней растений отнимают много времени, требуют опыта агрономов и ресурсов. Поэтому

Составление и подача декларации пожарной безопасности – это обязательное требование МЧС для многих категорий

Ограждение из ДПК для террасы также является популярным выбором благодаря своей эстетичности и функциональности.

Использование современной сельскохозяйственной техники является ключом к повышению эффективности и устойчивости сельского хозяйства.

Отсев дробления представляет собой строительный материал, получаемый в результате переработки твердых пород камня.

Влагомеры, или гигрометры, являются важным инструментом, используемым во многих сферах для определения уровня влажности

По каким принципам металлоконструкции подразделяются на виды, какие именно здания входят в каждый класс,

Применение минеральных удобрений позволяет добиться оптимального роста и развития растений, увеличить их продуктивность и

Грунт для рассады из природной почвы в кировской области, обеззараживание и облагораживание почвенной смеси.

Качественное проектирование домов и коттеджей требует не только технических знаний, но и творческого подхода.

Смазывание специальными маслами или смазками помогает предотвратить износ и коррозию, а также обеспечивает плавность

Предпосевная обработка почвы — ключевой этап в агротехнической цепочке, который оказывает значительное влияние на

Душевые поддоны из нержавеющей стали стали популярным выбором для современных ванных комнат благодаря своей

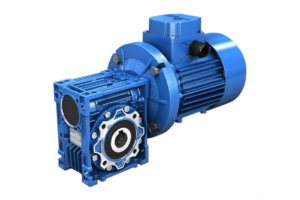

При выборе цилиндро-червячного редуктора важно учитывать ряд параметров, включая мощность двигателя, необходимую передаточную мощность,

Редуктор – это механическое устройство, предназначенное для передачи и преобразования крутящего момента и скорости

Говядина в полутушах - это один из наиболее распространенных и предпочитаемых видов мяса в

На сайте https://metallolom-moscow.ru/priem-stali можно найти подробную информацию о процессе приема стали и условиях сотрудничества.

Наверное, многие люди, которые даже не открывали учебник Химия 8 класс, наверняка слышали о

Камины и печи с живым огнем стали неотъемлемой частью интерьера многих домов, предоставляя не

Саженцы смородины являются популярным выбором для садоводов, благодаря их высокой урожайности и полезным свойствам

В этой статье мы поделимся 10 бюджетными идеями оформления свадьбы, которые помогут вам не

Сварочные столы являются ключевым элементом оснащения любой мастерской, занимающейся сварочными работами.

Среди множества средств для лечения и профилактики этого заболевания выделяется гель "Дар Дракона", сочетающий

В условиях, где требуется надежный и эффективный обогрев больших промышленных и коммерческих помещений, стационарные

Заправочные станции, являясь важной частью инфраструктуры любого города, представляют собой не только место для

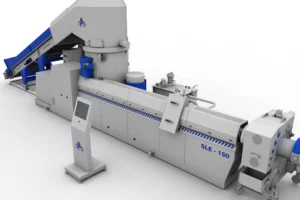

Экструдер для пластика — это основное оборудование в индустрии переработки пластмасс, предназначенное для формирования

Азот высокой чистоты получают с помощью методов криогенной дистилляции воздуха или с использованием мембранных

Откройте мир живых изгородей - оазиса зелени в вашем саду. Узнайте, почему туи играют

Выбор правильного саженца яблони — ключевой момент, который определяет урожайность, качество плодов и устойчивость